Digital Rupee in India – How Different It Is from Cryptocurrency?

The global payments industry is undergoing major change and transformation. Blockchain-powered cryptocurrencies are already ruling over the world. People are making huge investments in buying cryptocurrency. In India, Reserve Bank of India (RBI) launched the “Central Bank Digital Currency” (CBDC) – Retail pilot project, called the digital rupee.

With this launch, India is among the 10 countries that have successfully launched digital currencies. Top 10 Indian banks has joined hand together to promote digital rupee and connecting bank accounts to CBDC wallets. Here, we will see how the digital rupee is different from cryptocurrency and several key things that differentiate them from each other.

What is Digital Rupee?

Digital rupee is the digital form of the physical rupee issued and regulated by the RBI to make transactions and settlements easier than ever before. Based on Blockchain centralized network, it can be exchanged at par with physical cash and act as a safe store of value.

Digital rupees can be easily used for the settlement of secondary market transactions as well as the inter-banking market to make the process more efficient. Many countries are leveraging blockchain development consulting services to launch their own digital currency. Russia and China will soon launch their digital currency.

How Digital Rupee is Different from Cryptocurrency?

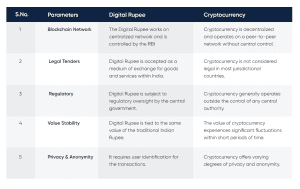

When we talk about cryptocurrency and digital rupee, the first and foremost thing we conclude that cryptocurrency and digital rupee are very much different from one another. A cryptocurrency is a form of currency that is virtual and uses cryptography to secure transactions in a decentralized blockchain network while digital rupee is a centralized form of money issued and regulated by the RBI.

Let’s see some of the points to know better about digital rupee in India with contrast to cryptocurrency. Digital rupee is a type of digital currency that is issued and managed by Reserve Bank of India. It is just the digital form of physical currency with the central bank being responsible for the management and distribution of the currency.

Also Read: How Blockchain is Delivering Potential Solutions for Healthcare Industry?

It can be used in the same way as physical currency is used as a medium of exchange for goods and services. On the other hand, Cryptocurrency is a digital currency that is not backed by any government or central bank. It operates independently of any central authority and uses encryption techniques to secure transactions with blockchain technology development and consulting.

Digital rupee is based on a private blockchain. All the transactions operate within the defined network and allow intermediary within permissible structure to take part in the operations. Cryptocurrency allows a peer-to-peer system where anyone can send and receive payments without an intermediary. It works on a public blockchain infrastructure that records all transactions.

Digital rupees are typically designed for use as a medium of exchange for goods and services and for day-to-day transactions. It is backed by the government or central bank which means that they are secure and reliable while Cryptocurrency is primarily used for investment purposes.

Random users or investors are meant to be bought and held as an investment, though in some cases the merchants have started accepting transactions via Cryptocurrencies while establishing a payment gateway with the help of enterprise blockchain app development company.

What are The Benefits of Digital Rupee?

- Digital rupees aim to deliver faster mode of payment of huge payments. Indian government has interlinked various banks and corporate with the digital rupee payment system to transfers and make hassle-free transaction.

- Digital currency opens a wide scope for cheaper global transfer of money. The main aim of RBI is to reduce the global transactions rates. Businesses and individuals are charged high fees to move funds from one nation to another. Digital rupee will interrupt these rates by making the transaction cost-effective and quick.

- Existing traditional money transfers frequently take more time during weekends and outside normal working hours. Digital rupee provides the ability to make a transfer 24/7 because banks are shut and cannot confirm transactions.

- The digital rupee increases transparency by allowing for real-time tracking as well as improving services for the government sectors and banks. Thus, it mitigates the volatility risk and maintains and regulates safety.

Also Read: Top 5 Web 3.0 Trends That Will Go Big in 2023 and Beyond

Conclusion

Digital Rupee aims to address problems associated with existing physical currencies and cross-border transactions. Blockchain technology development and consulting companies like Clavax Technology help in building blockchain-powered crypto platform that enhance business scalability and make the transaction process easier.